The Promise of AI in Crypto Trading

The idea of a fully-automated crypto trading bot is appealing. In theory, it removes human error, trades around the clock, and delivers better outcomes through data-driven decisions. New platforms launch weekly, each claiming to make trading effortless. Plug in your capital, let the bot do the work, and wake up to profits.

For many new investors, that pitch feels irresistible. It seems like skipping years of technical analysis, emotional swings, and trial-and-error mistakes. It offers the illusion of having a clear edge.

However, despite the hype, most investors still prefer human fund managers. Recent data shows more than 85% of investors continue to trust human-led strategies over fully-automated systems. Many assume this is only about trust, but performance plays a key role, especially in volatile markets like crypto.

The Rise (and Reality) of Automated Crypto Trading

Automation isn’t the problem. Blind automation is.

Algorithmic tools offer real advantages. Crypto bots can scan markets 24/7, execute trades without emotion, and run strategies with speed. For professional traders, these are essential features.

Most retail-facing bots, however, have one major flaw: a lack of transparency.

They act as black boxes. Users often have no insight into what the algorithm does, which data it uses, or how it reacts to market stress. Many haven’t even been tested beyond bull market conditions.

In high-frequency environments, bad data leads to bad trades. In a crypto market defined by noise and volatility, context matters as much as code.

Even top-tier quant funds like Renaissance Technologies and Two Sigma combine automation with human oversight. Why? Because even the most advanced models can’t predict the unpredictable geopolitical risk, regulatory shifts, or sudden market panic.

Why Humans Still Have the Edge

Machines dominate when markets are stable and data is clean. They’re faster, more efficient, and emotionless.

But when chaos hits, and in crypto, it often does, humans outperform.

Experienced traders can:

- Interpret signals before they appear in the data

- Adjust strategies based on context, not just code

- React in real time to news, sentiment shifts, and emerging risks

Fully automated bots can’t do this. They follow predefined logic, often without real-time risk monitoring or adaptability. That works in calm conditions, but becomes dangerous when markets break down.

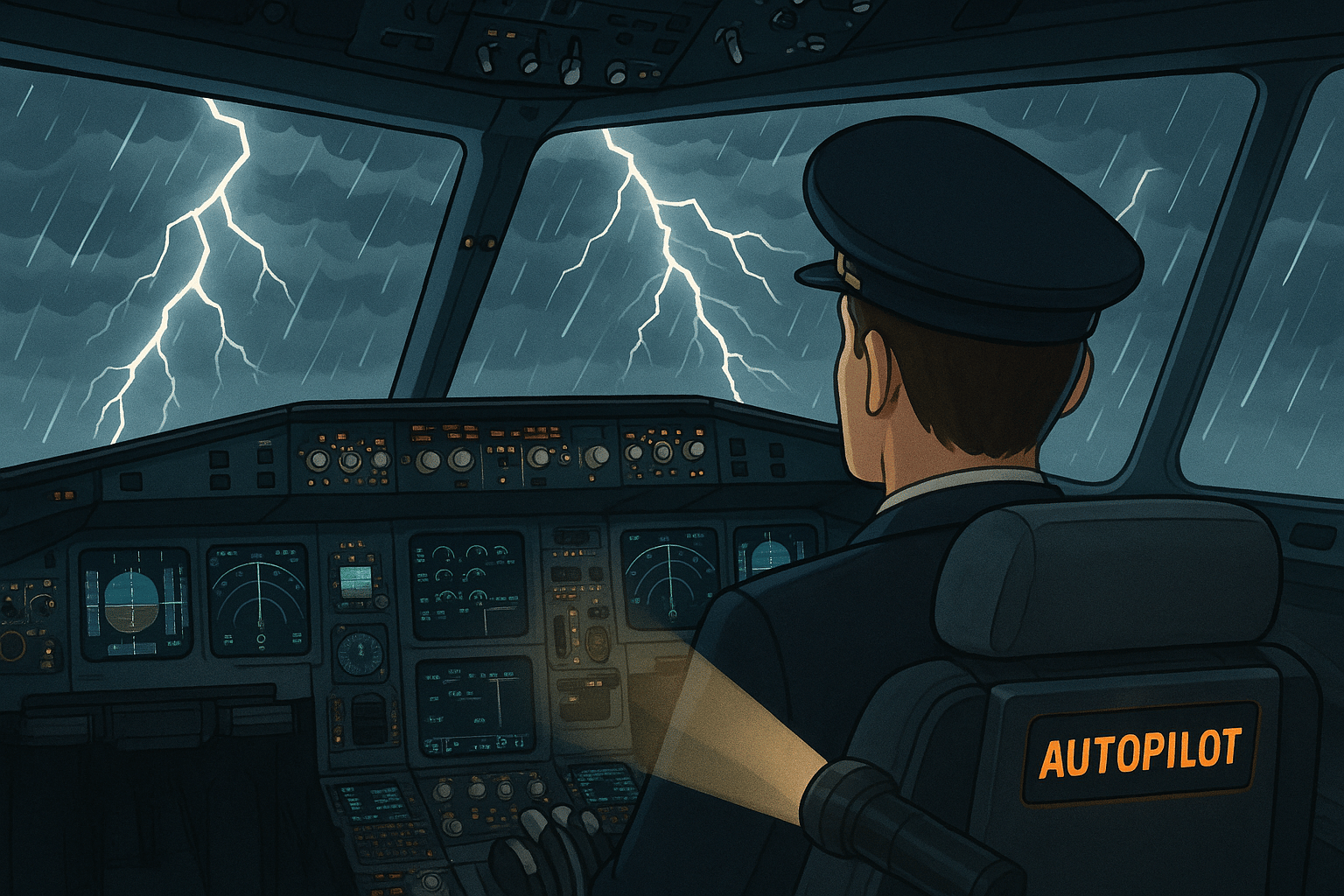

Professional funds now prefer hybrid models. Machines assist, but humans lead. It’s similar to aviation. Autopilot handles the cruising, but when turbulence hits, a pilot takes over.

In trading, that balance isn’t optional, it’s essential.

The Hidden Costs of Crypto Bots

Building a high-quality trading bot is complex. It requires:

- Clean, high-frequency data

- Skilled quant developers and data scientists

- Ongoing model validation and stress testing

- Sophisticated risk controls and monitoring system

Most retail-facing bots skip these steps. Instead, they offer flashy dashboards, “plug-and-play” setups, and little transparency. Many rely on recycled open-source strategies.

These tools aren’t built for performance. They’re built to acquire users.

Some smaller funds even use the same retail-grade tools behind the scenes, rebranded to look premium. The result? Investors face more risk than they realize, with no safety net when systems fail.

This isn’t automated investing. It’s speculative automation disguised as innovation.

What Smart Investors Are Doing Instead

Here’s the good news: smarter investors are moving beyond the false choice between AI and humans. They’re embracing hybrid strategies that combine both.

In this model:

- Machines identify patterns, manage execution, and handle repetitive tasks

- Humans interpret context, adapt strategies, and manage risk

This approach has already proven itself in traditional finance. As crypto matures, it’s becoming the new standard here too.

Before trusting any automated platform with your capital, ask:

- Who built the model?

- What’s the data source?

- How is it monitored and updated?

- What’s the risk strategy during a crash or black swan event?

If the platform can’t answer these clearly, it’s not a trading solution. It’s a gamble.

Closing Thoughts: Smarter Investing Starts With Better Tools

The future of crypto investing isn’t about choosing between humans and machines. It’s about combining their strengths. Automation can enhance your edge, but it won’t replace sound judgment, experience, and real-time decisions.

If staying on top of the market feels overwhelming, or you don’t have time to research and rebalance, there’s a smarter alternative.

BostonTrading offers a “done-for-you” ethical crypto mutual fund. Their flagship fund, Bostoncoin, is diversified across 30 to 40 coins and managed by a professional hedge fund manager. It’s designed for investors who want crypto exposure without the daily grind.

You get transparency, diversification, and active management, without watching charts or tracking news 24/7.

Explore how it works and join the community at BostonTrading.

Ready to take control of your future?

If you’re interested in getting started in crypto, here are a few platforms and tools that can help you along the way:

Browse and Earn: Want to earn free crypto just by browsing the internet? Try Brave Browser – it blocks ads and rewards you while you surf. Click here to start

Get free crypto by paying your bills! Use the prepaid CRO Visa debit card to pay for purchases and receive 3% cash back on purchases, up to 100% rebate for streaming services. No account fees, no interest charges, and no credit checks. Use this link to get a free US$25 when you open an account.

Wayex, you can purchase cryptocurrencies using this link to sign up and get a 30 days of fee free trading and up to $100 in trading bonuses.

For the Aussies: Coinstash is an Australian crypto exchange based in Brisbane. New users can get $10 free on signup using this link

After you purchase any cryptocurrencies, if you would like to store the coins in offline devices for safety, you can use Ledger

Independent Reserve — one of Australia’s oldest and best value crypto exchanges, since 2013. You can sign up here.

If you have a business and would like to accept payments in Bitcoin or crypto, click here — fees from 1% (less than credit card or PayPal)

Congratulations on educating yourself about this crypto project through Cryllionaire.com. We also profile a few coin projects, CEO interviews, and group chats on our YouTube channel.

Disclaimer: The content provided on this blog is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions, especially in the cryptocurrency market.